Platform Features

Comprehensive investment research tools powered by quantitative analysis and institutional-grade data

Rating Report

Get comprehensive insights with PTR's Value Trend Rating – our quantitative rating system covering 5,500+ stocks. Each rating combines deep fundamental analysis with market timing indicators to identify the most attractive investment opportunities.

Stocks rated A and B generally have high Appreciation Scores and high Power Ratings, positioned to outperform the market over the following 12–24 months. Conversely, F and D rated stocks are expected to underperform with lower appreciation potential.

Each report includes operating and investment performance benchmarks compared to company-specific peer groups, covering the key drivers of value: profitability, growth, and risk.

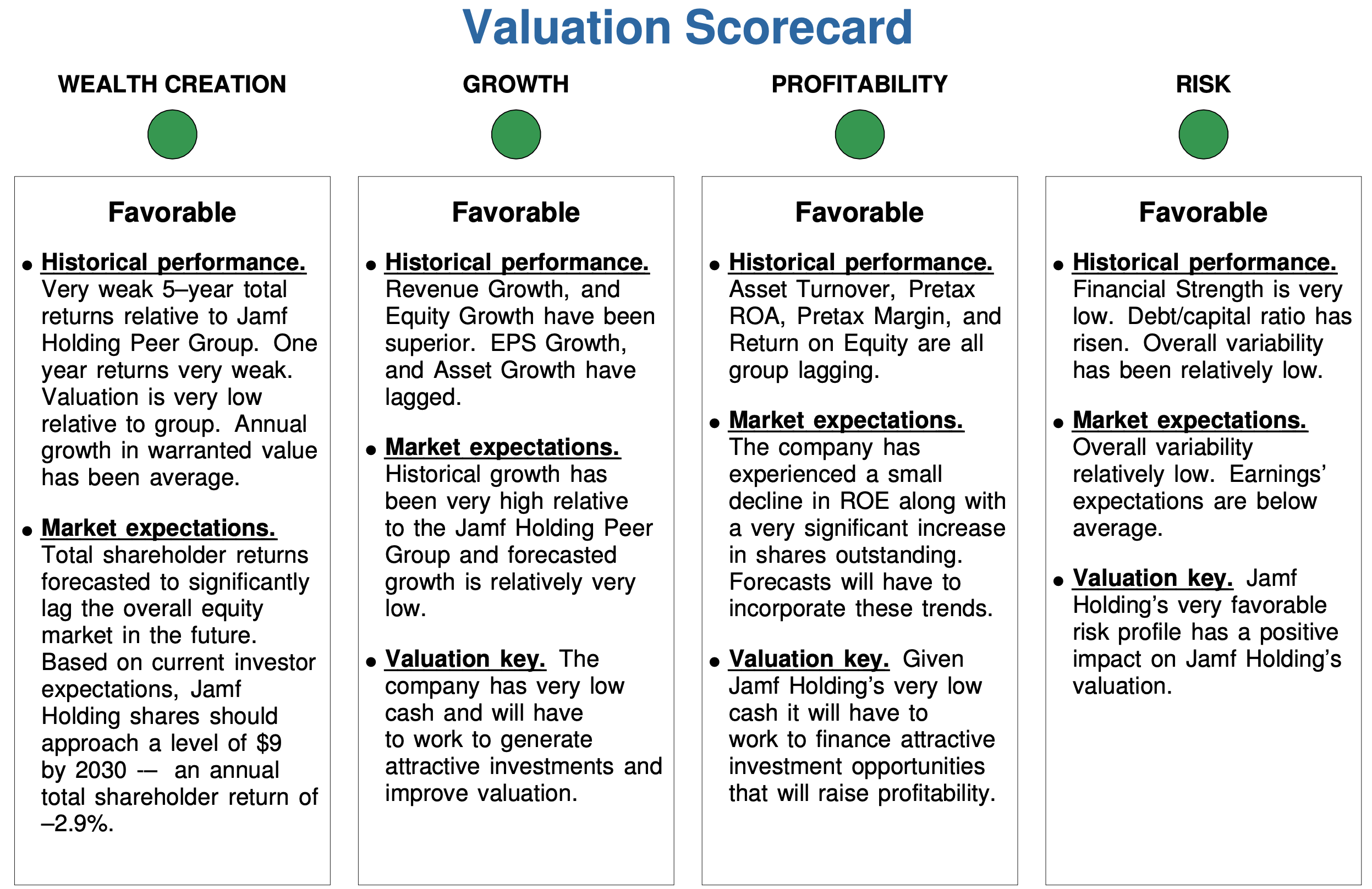

Valuation Scorecard

Answer the critical Value Challenge: "What level of company operating performance will be required to achieve a targeted level of investment return?"

Our Valuation Scorecard presents performance benchmarks for the key drivers of warranted market value:

- Valuation – Current pricing relative to intrinsic value

- Total Returns – Historical and projected performance

- Profitability – Operational efficiency metrics

- Growth – Revenue and earnings expansion potential

- Risk – Volatility and downside protection measures

- Wealth Creation – Long-term value generation capacity

All benchmarks are compared against company-specific peer groups, providing contextual analysis that reveals relative strengths and weaknesses.

A Few Quick Things

Stay current with concise, highly focused analysis designed to answer the essential questions: "Am I up-to-date?" "What's currently important?" "What do I need to know?"

This streamlined research report provides quick insight into a company's current investment and operating status, perfect for busy professionals who need immediate clarity.

- Current Investment Suitability analysis

- Operating Profile overview

- Recent alerts and developments

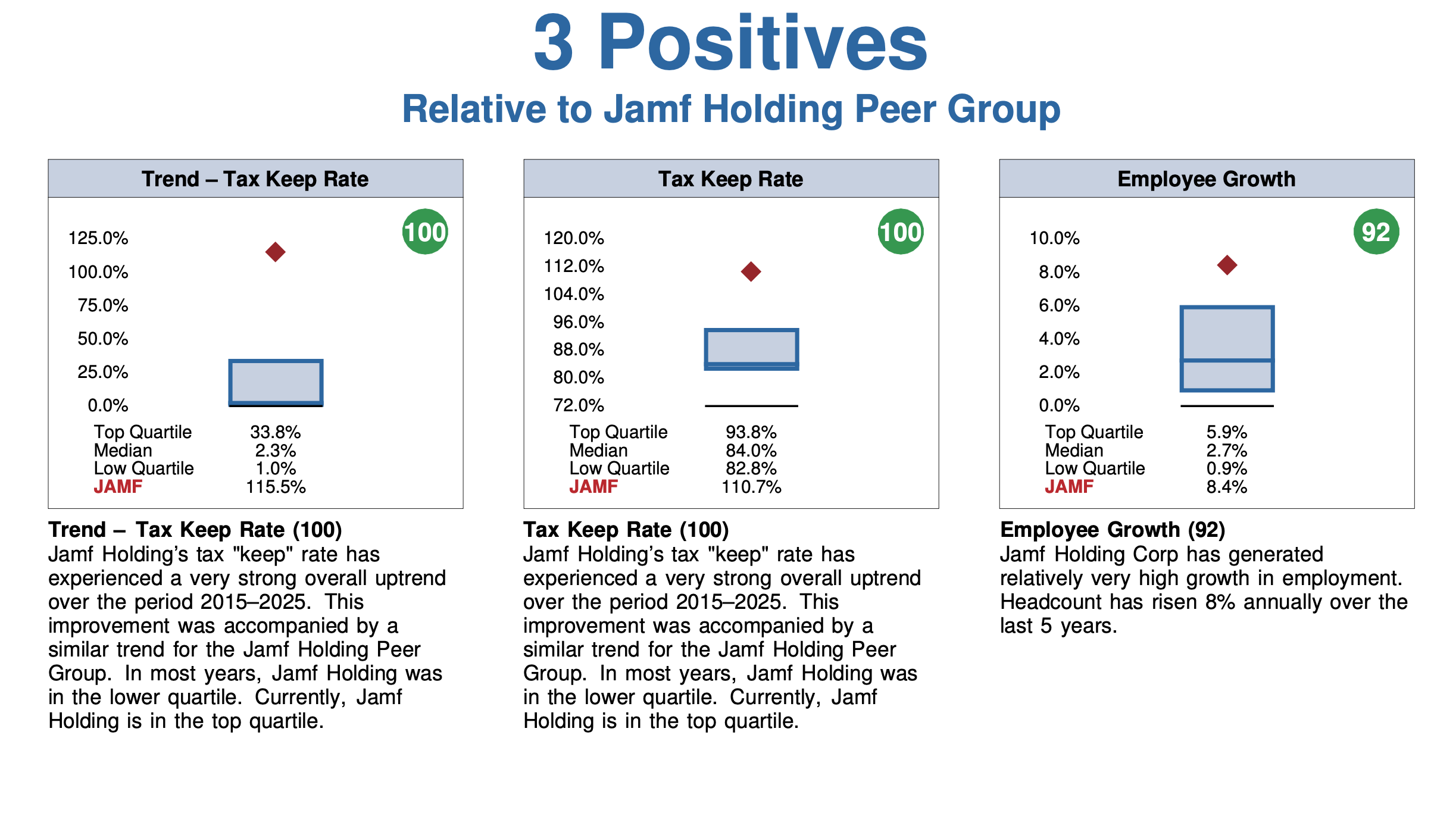

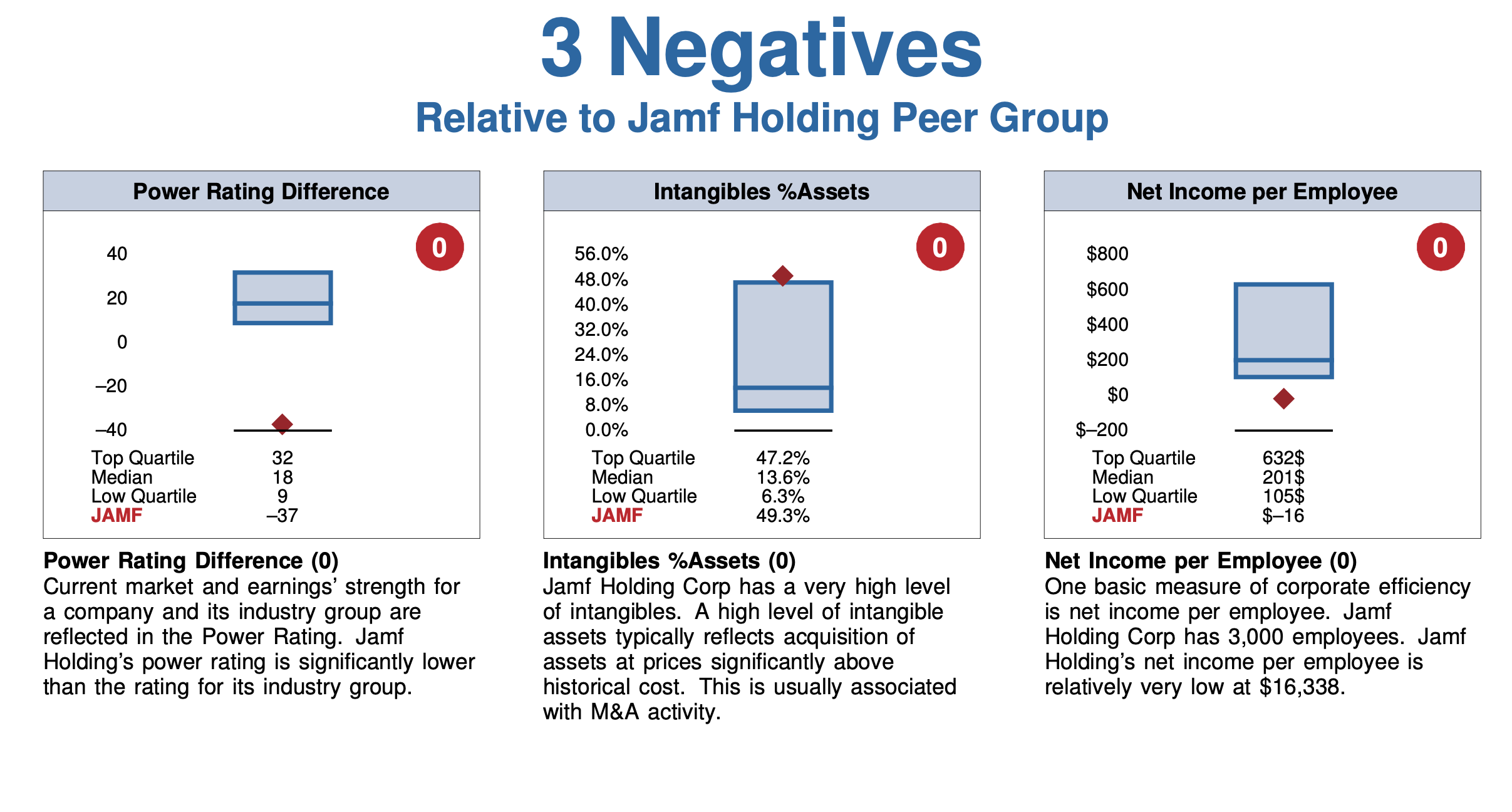

- Six key benchmarks (3 positive, 3 negative) vs peer group

- Current Value Trend Rating

Equity Intelligence Monitor

Capital markets anticipate. Our market-driven early warning system transforms the wealth of actionable information from investors and markets into competitive advantage.

Built on the principles of constant awareness, zero surprises, and change focus, the Intelligence Monitor helps identify longer-term, exploitable fundamental trends across 5,500+ companies.

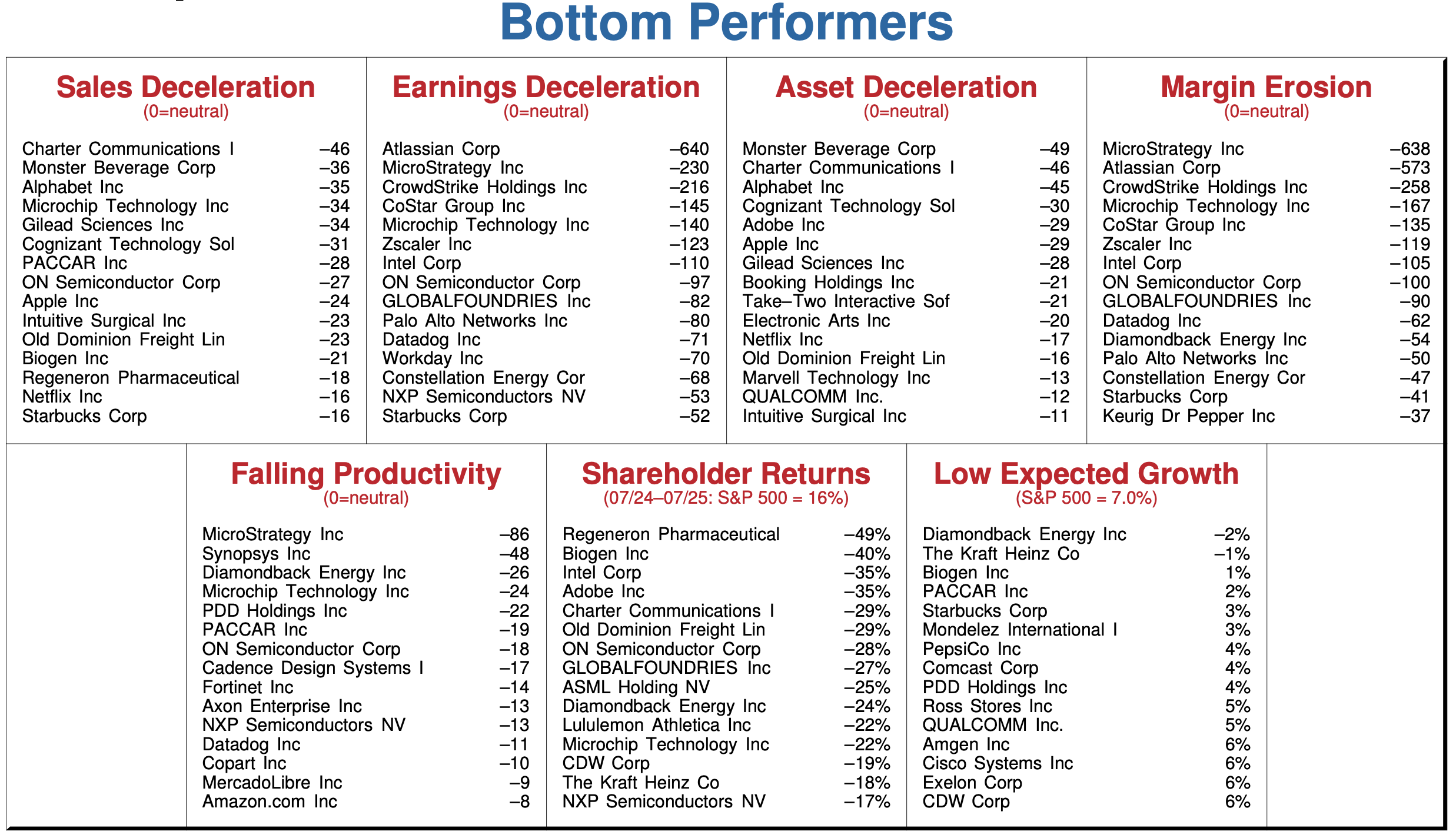

Relentlessly track companies and groups of interest. Get actionable intelligence on overall market trends, sector prospects, and identification of new leaders and laggards before the market catches on.

Whether you're monitoring a watch list or scanning for new opportunities, the Intelligence Monitor ensures you're always one step ahead of market developments.

Comprehensive Alert System

Never miss significant developments that may indicate important changes in future fundamentals or investment results. Our alert system covers all companies traded on North American stock exchanges with daily updates.

Alert Categories:

- Rating Changes – Updates to PTR's Value Trend Ratings based on fundamental analysis and timeliness factors

- New Earnings Reports – Quarterly sales and earnings performance vs analyst expectations

- Significant Market Action – Major positive or negative price movements

- Investment Signals – Important changes in price behavior and trading volume

- Fundamental Signals – Key changes in growth metrics and market expectations

Each alert provides context and analysis to help you understand the significance and potential impact on your investment decisions.

Ready to Experience These Features?

Join thousands of investment professionals who rely on PTR's comprehensive research platform for better investment decisions.